This week's newsletter co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($20,022): -7% / -58%

- ETH ($1,482): -9% / -60%

- XRP ($0.33): -3% / -60%

- UNI ($5.98): -17% / -65%

- Crypto Market Cap ($966B): -6% / -56%

- BTC Dominance: 40%

- ETH Dominance: 19%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($67B): 0% / -14%

- USDC ($52B): -1% / +23%

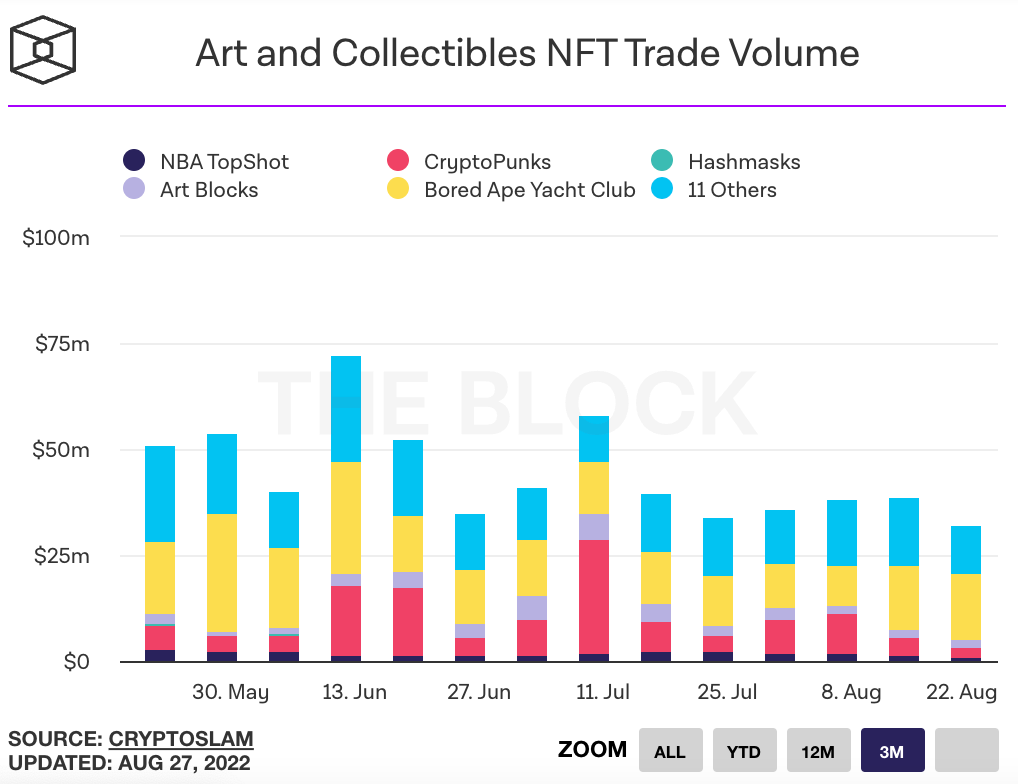

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Crypto markets whipsawed following Federal Reserve chairman Jerome Powell’s warning that high borrowing rates were not going away soon, and that there is more economic pain on the horizon. BTC and ETH fell nearly 10% on the news. Link. Link.

- SEC chair Gary Gensler wrote an op-ed in the WSJ discussing the SEC’s role in enforcing securities laws, and said the agency would not treat the crypto markets any differently. Link.

- The Merge, Ethereum’s move to proof of stake from its current proof of work model, will kick off with the Bellatrix update on September 6. This will begin a 14-day period to the mainnet Merge, which is expected to occur on September 20. Link. EF Blog Post.

- NFT marketplace volumes fell to $370 million in August, down from $675 million in July. Link.

- DeFi lending platform Compound launched Compound III, a new version of the protocol that shifts away from the pooled-risk approach where users can borrow any asset. Instead, each instance of Compound III will feature a single borrowable asset and will limit the tokens that can be deposited as collateral. This new approach should eliminate the risk of a single bad asset draining all assets from the protocol. Initially, Compound III will allow users to borrow USDC using ETH, wBTC, LINK, UNI and COMP as collateral. Though users won’t earn interest on collateral anymore, they will be able to borrow more and have less risk of liquidation and lower liquidation penalties. Link. Medium Post.

- Some fear that technical difficulties with Ethereum’s upcoming Merge and move to proof of stake consensus mechanism could lead to network downtimes for DeFi protocols that could affect stablecoin values and shrink DeFi lending pools. Link. Uniswap Labs assured users it would continue to operate seamlessly through the Merge. Tweet.

- The Senate is preparing a mid-September hearing on a bill that would name the CFTC as the primary regulator for crypto exchanges. The bill has received widespread support from the crypto community. Link.

- Tether announced it was not freezing sanctioned wallets with ties to Tornado Cash until being advised to do so by the US government. Tether said it is in near daily contact with the US government and has not been explicitly told to do anything in response to the sanctions. Link.

- Cryptocurrency miners in Texas have applied to use up to 33 gigawatts of electricity, a third more than what officials were preparing to handle over the next decade, and enough to power all of New York State. Link.

- OrangeDAO has raised $80 million to back web3 startups. The group will leverage over 1,000 YC alumni to crowdsource crypto investment opportunities. Link.

- India’s financial crime-fighting agency is alleging that crypto exchange CoinSwitch Kuber violated forex laws. The startup is valued at nearly $2 billion and backed by a16z and Sequoia India. Link.

- The Taliban started a widespread crackdown on crypto, detaining 13 people who were using crypto to shield their assets from the government and shutting down 20 crypto-related businesses. Link.

- OpenSea’s former Head of Product, Nathaniel Chastain, filed a motion to dismiss wire fraud charges on the basis that NFTs are neither commodities nor securities and hence can not be used as evidence of wire fraud. Link.

- Coinbase launched a voter registration tool that will inform users on where their representatives stand on crypto regulation and how they can engage in the debate ahead of the November midterm election. Link.

- Snoop Dogg and Eminem will perform their new single “From the D to the LBC” from inside Yuga Lab’s Otherside Metaverse at the upcoming MTV Video Music Awards. Link.

- Coinbase said it would “evaluate” any Ethereum proof of work forks that arise after the Merge. Link. Link. Blog Post.

- DeFi protocol Synthetix is considering moving away from its current inflationary token model and capping the supply of its tokens at 300M. Founder Kain Warwick says the inflationary model worked for bootstrapping the network, but is no longer needed because the protocol is generating revenue from its atomic swap and perpetual products. Link.

- Japan is considering a tax reform for 2023 that would exempt crypto startups that issue their own tokens from paying taxes on unrealized gains. Investors in Japan are taxed up to 55% on capital gains, making it very expensive for crypto startups to operate in the country. Link.

- FTX CEO Sam Bankman Fried has denied that FTX Ventures is merging with Alameda Research. Link. Link.

- Tornado cash developer Alexey Pertsev has been ordered to remain in jail for at least another 90 days. The developer was arrested in relation to the US Treasury Department sanctioning Tornado Cash but it is still unknown the exact charges and/or details of Pertsev’s arrest. Link.

- Reddit is airdropping polygon NFTs to users above a certain karma threshold. The NFTs will also be available for sale to the general public and is the latest Web3 initiative after the platform announced it’s working with Ethereum L2 Arbitrum to tokenize community points. Link.

- Lending rates have increased between 0.5% and 2% over the past month across most major lending platforms due to less liquidity caused by the collapse of major lending platforms like Celsius and Voyager. Link.

- Ethereum infrastructure provider Alchemy acquired Ethereum boot camp platform Chainshot and plans to offer its $3,000 bootcamp for free to users who want to learn solidity. Link. Link.

- Alameda research co-CEO Sam Trabucco resigned this week, citing personal reasons. Caroline Ellison, who was appointed co-CEO with Trabucco in 2019, will continue as sole CEO. Link.

- Blockchain analytics firm Elliptic reported that $100 million worth of NFTs were stolen in the last year. The three most popular collections for theft were Bored Ape Yacht Club, Mutant Ape Yacht Club and Azuki, with thefts peaking over the past 3 months. Link. Link.

- Coinbase unveiled cbETH, a liquid staking token that will compete with Lido’s stETH token. Both cbETH and stETH are liquid staking tokens given to users in exchange for depositing their ETH in staking pools to earn mining rewards in Ethereum’s new proof of stake model. cbETH and stETH can eventually be redeemed for ETH 1:1, but in the meantime these tokens provide a proxy for users to continue using ETH. Link.

- After weeks of community comments, the Sushi Swap DAO passed a proposal to reduce their chief executive (known as “Head Chef”) compensation, setting the stage for a follow up proposal to appoint Jon Howard as its new Head Chef. Link.

- Candy brand Mars signed a deal with UMG label 10:22PM to create limited edition M&M’s based on Kingship, its virtual band made up of Bored Ape Yacht Club and Mutant Ape Yacht Club avatars. Link.

- Coinme customers will now be able to purchase Ethereum, Dogecoin, Litecoin, Chainlink, Stellar and Polygon via cash deposits at its 21k kiosk stations located across the US. Customers can already use the service to purchase Bitcoin. Link.

- Troubled crypto lending platform Celsius filed a countersuit against Jason Stoner (0xb1) and his company KeyFi, alleging that Stone and KeyFi stole millions of dollars in coins from Celsius-controlled wallets. The suit also alleges that Stone used Celsius coins to buy hundreds of NFTs, which they then sent to their own wallets. Link. Link.

- US Representative Tom Emmer wrote a public letter to Janet Yellen asking why Tornado Cash, a service that runs on smart contracts, was being sanctioned. “The sanctioning of neutral, open-source, decentralized technology presents a series of new questions which impact not only our national security, but the right to privacy of every American citizen.” Link. Letter.

- NFT collection Pudgy Penguins, which first launched in June 2021, saw its floor price rise over 83% in the past two weeks. The collection also announced a new advisory board that includes Nansen’s CEO, Saks Fifth Avenue’s COO, and Hasbro’s Head of Licensing. A rare Penguin sold for $630,000 shortly after the advisory board announcement. Link.

- Samsung ventures announced the launch of a crypto exchange in South Korea in 2023. The firm tried launching an exchange last year but could not hire the right professionals to run it. Link.

- A cryptography professor at John Hopkins University posted an archival fork of Tornado Cash’s source code to GitHub, weeks after the codebase had been taken down following US sanctions and the arrest of Tornado Cash’s lead developer. The professor intends to preserve the source code for research purposes, rather than deployment. Link.

- Blockchain indexing platform The Graph is adding support for Gnosis Chain on its decentralized Graph Network, making it the first chain outside of Ethereum the platform supports. Graph Network is a decentralized version of The Graph’s centralized hosted service. Link.

- Chip giant Nvidia saw its cryptocurrency mining processor (CMP) sales fall 66% from $266 in Q2-21 to $140 million in Q2-22. Link.

- The SEC delayed a decision on VanEck’s bid to create a spot bitcoin ETF until October. Grayscale’s spot Bitcoin ETF application was denied in June. Link.

- Cryptocurrencies account for 75%, or $1.1 billion, of foreign exchange violations in South Korea. Most of these violations stem from taking advantage of arbitrage opportunities that are illegal for South Korean exchanges (commonly referred to as the “kimchi premium”). Link.

- Sotheby’s hired NFT specialist Arthemort to join its digital art team. Link.