This week's newsletter was cowritten by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($24,810): +7% / -47%

- ETH ($1,980): +16% / -47%

- XRP ($0.38): +2% / -55%

- UNI ($8.99): +1% / -48%

- Crypto Market Cap ($1.2T): +7% / -47%

- BTC Dominance: 40%

- ETH Dominance: 20%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($67B): +1% / -14%

- USDC ($54B): -1% / +26%

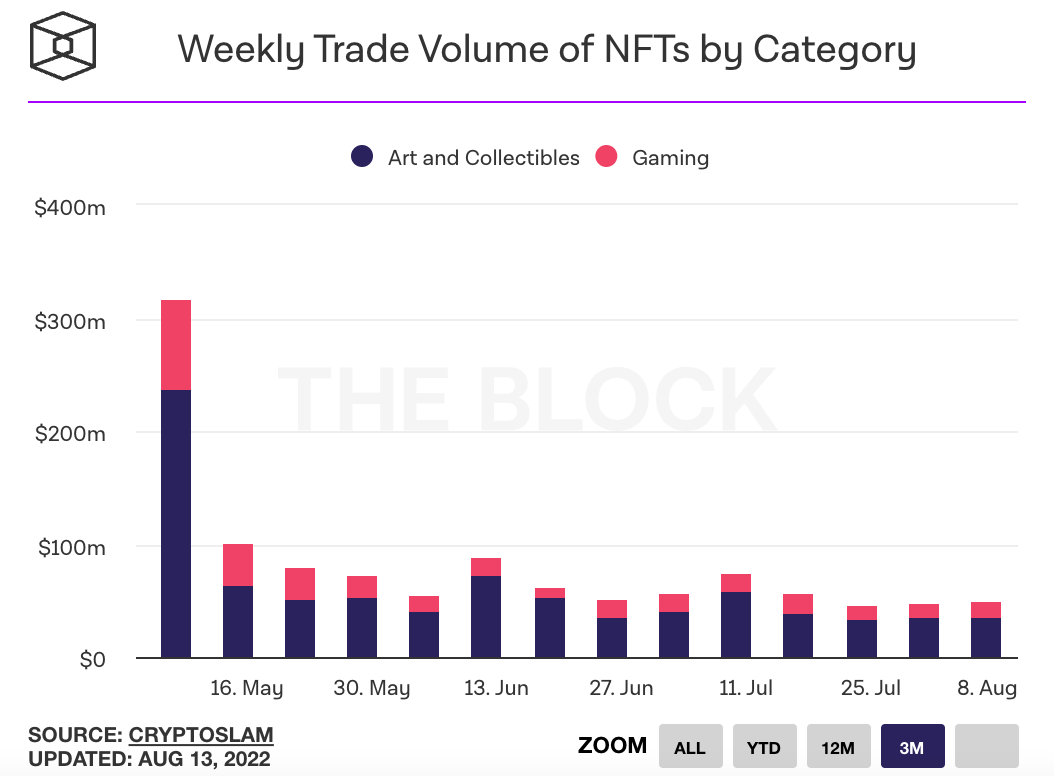

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Bitcoin briefly topped $25,000 for the first time since mid-June, amid better than expected US inflation data and anticipation of Ethereum’s upcoming Merge. Link.

- Ethereum’s final merge to a proof of stake consensus mechanism has been scheduled for Block XYZ, which is expected to occur on September 15 or 16th. The announcement comes after a major testnet merge of the Beacon Chain was completed earlier this month. Link. Link. Vitalik Tweet.

- The US treasury sanctioned Tornado Cash, a cryptocurrency mixing service that is accused of being used to launder over $7 billion of cryptocurrency since 2019. The sanctions target 44 Tornado Cash related smart contracts and wallet addresses, and bars any US person or business from using the service. Link. Link. Circle responded by freezing the USDC held in sanctioned wallets and GitHub suspended contributors to Tornado’s open-source codebase. Link.

- A developer involved in Tornado Cash was arrested in the Netherlands, just days after the US announced sanctions against the open-source protocol. The exact charges are not yet known. Link.

- Coinbase is under investigation by the SEC for security violations over its token listing process and yield-generating staking programs. Link. Link.

- MakerDAO, the DeFi protocol behind collateralized stablecoin DAI, wants to sell its USDC collateral in favor of more decentralized cryptocurrencies like ETH or other stablecoins. DAI is currently predominantly collateralized by USDC. The proposal comes in light of Circle complying with US sanctions and blacklisting wallet addresses associated with Tornado Cash. Link. DAI Treasury.

- The SEC and CFTC are proposing that hedge funds managing more than $500 million must disclose cryptocurrency exposure through confidential filings. Link.

- Curve Finance, one of the largest DEX’s in terms of total value locked (TVL), was hacked this week. A hacker cloned the Curve website and redirected its DNS point to the hacker’s IP address. Approximately $570,000 was stolen. Link. Link.

- Circle said its USDC stablecoin would support the Ethereum proof of stake chain after the Merge. Tether announced the same for USDT. Link. Link.

- Blockchain oracle chainlink announced it would support the Ethereum merge and not the PoW hard-fork. Link. Post.

- Blackrock, the asset manager with over $10 trillion of AUM, launched a spot Bitcoin private trust to give its institutional clients direct access to the cryptocurrency. The announcement comes just days after it announced a partnership with Coinbase to give its asset management clients access to Coinbase Prime. Link.

- Hedge fund billionaire Steve Cohen is launching a crypto-specific asset manager. The company will focus on spot trades, crypto derivatives and providing capital to other crypto-focused hedge funds. Link.

- Magic Eden submitted a proposal this week to ApeCoin DAO to build a dedicated NFT marketplace for ApeCoin. The marketplace is launching in September at no cost to the DAO, and will offer reduced fees for transactions in $APE and for NFTs in the Bored Ape Yacht Club ecosystem. Link.

- Coinbase Q2 earnings fell short of analyst expectations with net revenues of $802 million and EPS of -$4.98. Retail and institutional trading revenue fell during the quarter and assets on platform fell nearly 63% qoq, from $256 billion to $96 billion. Coinbase attributed the decline to the macro decline in BTC and ETH prices. Link. Link. Link.

- FTX and Justin Sun are in talks to buy a majority stake in crypto exchange Huobi. The proposed deal would value the company at $2-3 billion and would be one of the largest acquisitions in crypto history. Link.

- NFT infrastructure provider Pinata raised an $18 million Series A co-led by Greylock and Pantera Capital. The company provides infrastructure for distributing and managing NFT media. Link.

-Yuga Labs hires the GM of MeebitsDAO, Danny Greene, as brand ambassador for Meebits. Greene will focus on utility and partnerships for the brand, and serve as a liaison with the community. Link.

- Decentralized exchange dYdX is blocking wallets that knowingly interacted with Tornado Cash. The policy was updated to exclude wallets that unknowingly interacted with Tornado-adjacent wallets. Link. Blog Post.

- Reddit is migrating its community points to the Arbitrum Nova blockchain. Points are used to reward subreddit activity and by moving them on-chain, Reddit is hoping developers can build more robust tooling around its rewards program. Link.

- Two Uniswap members submitted a governance proposal to form the Uniswap Foundation. The Foundation would be funded with $74 million from the DAO’s treasury and would give grants to developers and projects aimed at expanding the Uniswap ecosystem. Link.

- India has frozen over $46 million of assets from crypto exchange Vauld, for maintaining lax AML and KYC controls. Local authorities believe Vauld was used to launder money. Vauld recently filed for bankruptcy and reportedly owes creditors over $360 million. Link.

- Buenos Aires will deploy Ethereum validator nodes in 2023, becoming the first government to officially run infrastructure for the cryptocurrency. Argentina has been a huge proponent of crypto, and already allows citizens to pay their taxes with it. Link.

- Interlay, a DeFi platform on Polkadot, launched a decentralized version of wBTC called iBTC. Using the MakerDAO vault model, iBTC can be redeemed for BTC without a centralized 3rd party. Link.

- Crypto.com is acquiring digital payments provider PnLink and digital assets exchange OK-Bit, clearing the way for the company to operate in South Korea. Link. Link.

- Singaporean crypto lender Hodlnaut is the latest digital asset company to freeze customer withdrawals, citing market conditions. The freeze will last at least until August 19th. Link.

- Liquidity platform Paradigm (not to be confused with the VC firm) has partnered with FTX to offer futures spread trading. Paradigm already offers the trading strategy with other exchanges, but the partnership with FTX will give users access to futures spread trading across a wider variety of tokens. Link.

Thanks for helping me catch up on the news of the week!