PRICE CHANGE: WTD/YTD

- BTC ($30,287): -12% / -36%

- ETH ($2,086): -19% / -44%

- XRP ($0.43): -25% / -49%

- UNI ($5.21): -27% / -70%

- Crypto Market Cap ($1.3T): -18% / -41%

- BTC Dominance: 44%

- ETH Dominance: 19%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($76B): -9% / -3%

- USDC ($51B): +5% / +21%

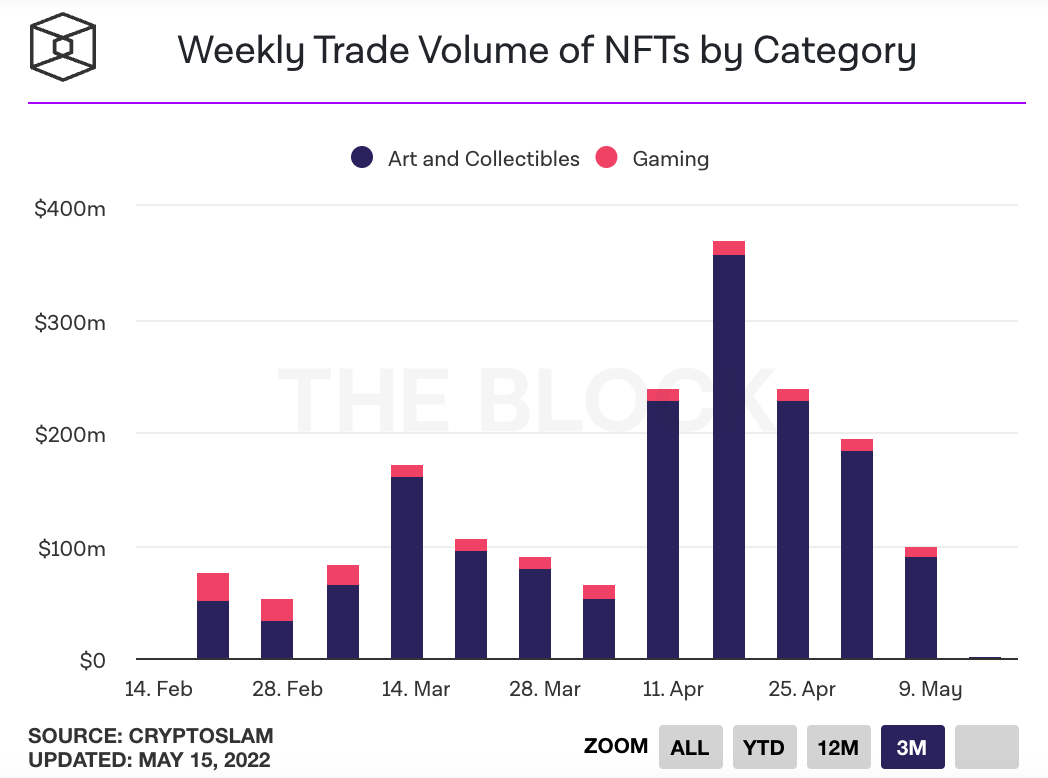

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- A multi-billion dollar protocol imploded this week, causing a greater sell-off across cryptocurrencies more broadly. Terraform Labs is behind algorithmic stablecoin UST (Terra USD) and Luna (the governance token of the Terra ecosystem). UST had grown to >$18 billion market cap through its Anchor dApp, which offered supposedly stable yields of 20% on UST. UST is pegged to 1 US dollar.

- Beginning May 7th the UST peg briefly fell and saw a brief flight to safety as some users sold out of Anchor. Terra has significant holdings of Bitcoin on its balance sheet which it can use to maintain the $1 peg if needed. Through a series of market events, some market makers sold sizable BTC positions in the open market, causing a decline in price and further exacerbating the selling pressure on UST.

- Anchor saw its deposits cut in half from $14 billion before the weekend to ~$6 billion on Monday. Withdrawals from Terra caused the UST peg to fall below $0.70 before eventually recovering to $0.90. LUNA was down about 50%.

- Continued rumors caused even more buying pressure, and an inflationary mechanism that introduced massive LUNA supply into the market resulted in LUNA price crashing to $0 and UST falling to $0.15.

- Summary overview

- Great overview with historical context (not official news source)

- Do Kwon's response

- CNBC Summary

- Other stablecoins speak out

- Binance indefinitely suspended the trading of Terraform Labs' Terra (LUNA) and TerraUSD (UST) tokens after the tokens lost nearly 100% of their value in just a few days. Other exchanges like FTX, Crypto.com, KuCoin, and OKX also suspected trading. Meanwhile Terraform Labs halted its Terra blockchain for the second time this week while it worked on a plan to reconstitute the protocol. Link. Twitter Announcement.

- Crypto lender Celsius, which allows users to earn 17% on their capital, withdrew $463 million from Anchor Protocol on May 11th as UST began unraveling. Link.

- Do Kwon, the co-founder and CEO of the firm behind the Terra blockchain, was revealed to be the cofounder of an earlier algorithmic stablecoin called Basis Cash which failed back in 2021. Link.

- Instagram said it would begin testing NFTs with select creators this week. Similar functionality is expected to come to Facebook soon. Link. Instagram is planning NFT integrations for Ethereum, Polygon, Solana and Flow and does plan to charge users for posting and sharing NFTs. Link.

- At one point this week Bitcoin and Ethereum were down almost 30%. Bitcoin hit its lowest price since 2020 and Ethereum briefly fell below $2,000. Link. Some cryptocurrencies like Solana were down 40% this week. Link.

- SEC chair Gary Gensler said that crypto exchanges that offer multiple services to customers are often in conflict with one another, including custody, market-making and trading. He raised concerns with stablecoins affiliated with exchanges, like Tether, USD Coin (USDC) and Binance USD. Link.

- Treasury Secretary Janet Yellen pushed for stablecoin regulation by end of the year during annual testimony in front of the Senate Banking Committee. She spoke as Terra's algorithmic stablecoin was depegging. Link.

- Gas fees on Ethereum rose as stablecoin activity increased during Terra's collapse. 22 billion in USDT (Tether) was moved on Ethereum earlier this week and transaction fees rose above $20. Link.

- Sam Bankman-Fried, founder of crypto exchange FTX, revealed a 7.6% stake in Robinhood. Shares of the startup rose 28% on the news. Link.

- Chainalysis raised $170 million Series F round led by GIC. The round values the company at $8.6 billion. Link.

- Coinbase's quarterly report included an updated risk disclosure that said if the company were to file for bankruptcy the court may treat customer assets as Coinbase's assets. Link. CEO Brian Armstrong's Tweets.

- The founder of NFT collection Azuki published a blog post revealing his involvement in past NFT projects, causing the collection's floor price to fall over 45% from 19 ETH to 10.9 ETH before climbing back to 14.1ETH. Community voiced concerns the founder's other projects were 'rugpulls', when a team abandons a project shortly after launch (while taking money raised). Link. Blog Post. Floor Price.

- Coinbase Q1 results included $1.16 billion of net revenue, $430 million in net losses, and trading volumes of $309 billion (a 43% decline from Q4's $547 billion of trading volumes). The exchange reported 9.2 million monthly transacting users. Link. Shareholder Letter.

- Coinbase NFT launched its public beta and saw fewer than 150 new users trade on the platform according to Dune Analytics. So far the platform has seen $1.1 million traded across almost 3k transactions. Link. Link. Dune Analytics.

- Solidus Labs raised $45 million in Series B funding to build its on-chain risk monitoring engine. Link.

- Dapper Labs announced a $725 million ecosystem fund for its Flow blockchain. Link.

- According to a new report from Chainalysis, 97% of the $1.7 billion of crypto stolen in 2022 so far has come from DeFi protocols. This is largely driven by 2 major attacks: $622 million from Axie Infinity's Ronin Bridge and $320 million from the Solana/Ethereum Wormhole bridge. Link. Chainalysis Report.

- Madonna and Beeple announced a three-video NFT collaboration called "Mother of Creation". The series was auctioned on SuperRare with proceeds donated to three charities. Link. Collection.

- Blue-chip NFT collections saw average sales price fall almost 30% over the last week, with transaction volumes down over 20%. The JPG NFT Index fell by about 26% this past week. Link. JPG NFT Index.

- NFT platform Zora raised $50 million from Haun Ventures at a $600 million valuation. Zora operates an open-source marketplace protocol. Link. Link.

- Napster, the once popular p2p audio file sharing platform, was acquired by Hivemind and Algorand. The group plans to recreate Napster in Web3. Link.

- Crypto users were targeted by phishing attacks on Etherscan, CoinGecko and other sites via a malicious ad code introduced by crypto ad platform Coinzilla. Link.

- Fantasy sports app Sorare will create a crypto game with the MLB. Fans will be able to buy and sell NFTs of baseball cards and assemble their fantasy teams. Link.

- David Marcus, the former head of Meta's crypto strategy, launched Lightspark, a crypto startup that is building backend infrastructure for companies, developers and merchants looking to transact on Bitcoin's Lightning network. Lightspark raised from a16z, Paradigm, and Coatue. Link. Link.

- Crypto exchange KuCoin raised $150 million from Jump Crypto at a $10 billion valuation. This was the exchange's first financing round in four years. Link.

- Yuga Labs, the company behind Bored Ape Yacht Club and metaverse Otherside, refunded gas fees for those with failed transactions during the Otherdeed mint. Link.

- Chainflip Labs raised $10 million from Blockchain Capital, Framework Ventures, and Pantera Capital to create a cross-chain DEX (decentralized exchange). The DEX does not plan to use the current popular bridging approach. Link.

- FTX.US applied for a trust charter with the New York Department of Financial Services. Link.

- Emirates Airline will begin accepting bitcoin as a payment method. Link.