Crypto weekly is co-authored by @serdave

PRICE CHANGE: WTD/YTD

- Crypto Market Cap ($2.6T): -4% / +47%

- BTC ($ 65,425): -4% / +54%

- ETH ($3,370): -7% / +47%

- SOL ($174): -10% / +71%

- UNI ($11.76): -6% / +61%

- MATIC ($0.99): -8% / +2%

- Tether Mkt Cap ($105B): +1% / +14%

- USDC Mkt Cap ($32B): +4% / +32%

- BTC / ETH Dominance: 49% / 16%

THIS WEEK IN CRYPTO

- Spot bitcoin ETFs experienced net outflows of $742 million, due to $1.4 billion in withdrawals from the Grayscale Bitcoin Trust. Link.

- Bitcoin, which tends to correlate with risk-on sentiment in equity markets, fell this week despite stock markets hitting record highs amid rate cut expectations later this year. Link.

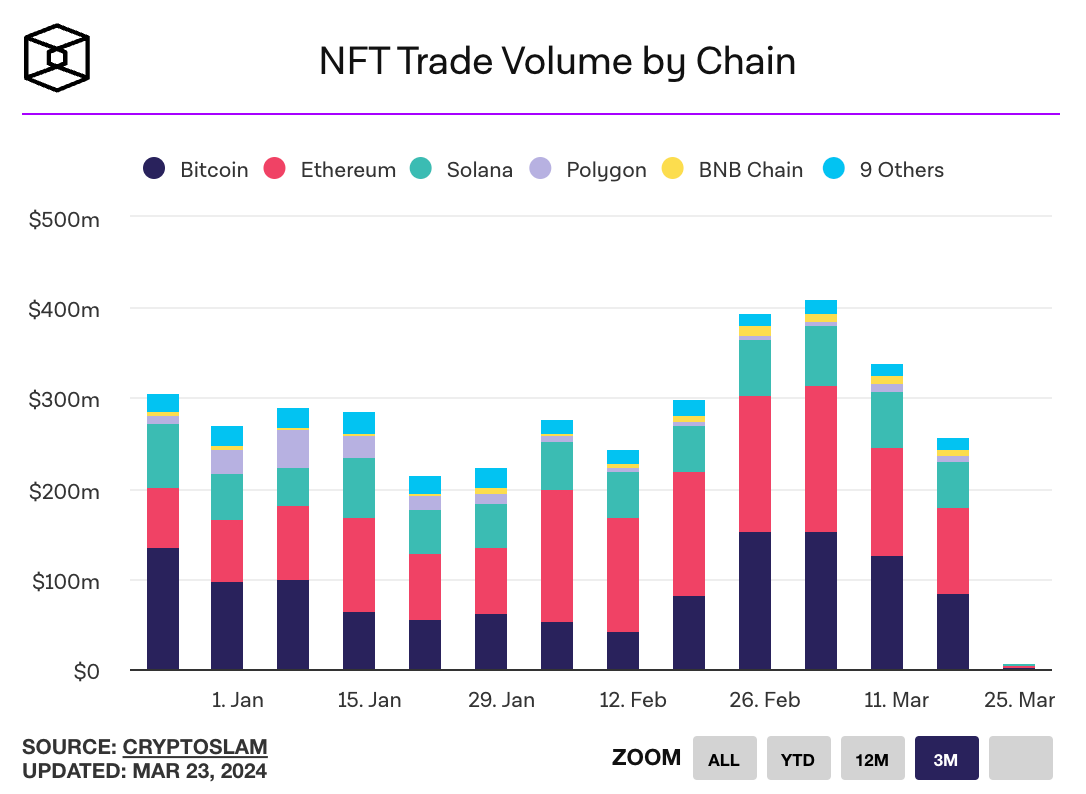

- Trading volumes on Solana grew 67% to $21.3 billion this week, driven largely by a surge in memecoin trading. Ethereum volumes grew only 3% to $19.4 billion. Link.

- Ethereum’s Dencun upgrade last week reduced gas fees across Layer-2s by over 90%, though developers caution that fees will rise as demand increases. Link.

- BlackRock, the world’s largest asset manager, is launching a tokenized private equity fund in partnership with Securitize. Link. Link. Form D filing.

- Google now shows balances of wallets that use ENS “.eth” names. Link.

- The SEC said it would take until May 30, 2024 to decide whether to approve Grayscale’s Ethereum futures ETF. The SEC is also reviewing spot Ethereum ETF applications. Link. Filing.

- The SEC is investigating Ethereum and issued subpoenas to US companies who have worked with the Ethereum Foundation, the non-profit that oversees the protocol. The investigation reportedly began in 2022 shortly after the blockchain’s shift to proof-of-stake. Link. Link.

- Daily transactions on Base, Coinbase’s Layer 2, saw record highs of daily users and transactions on the back of the Dencun upgrade which led to a dramatic drop in transaction fees on most layer 2s. Link.

- A federal judge sanctioned the SEC for its “bad faith” conduct in relation to a lawsuit against crypto company DEBT Box last year, when it had misrepresented key facts to obtain a temporary restraining order to freeze assets on the crypto platform. Link. Filing.

- The bitcoin halvening, which will reduce mining rewards from 6.25 BTC per block to 3.125 BTC, is expected to occur at the end of April. US miners have been upgrading equipment ahead of the event, and reselling older hardware to miners in countries like Ethiopia, where electricity costs are low enough to still earn a profit after the halvening. Link.

- Software company MicroStrategy now owns over 1% of all BTC, after purchasing another $1.4 billion in BTC. It’s BTC holdings are currently valued around $14 billion. Link. Link.

- Montenegro’s Supreme Court suspended a lower court’s decision to extradite Terra/Luna founder Do Kwon to South Korea. Do Kwon was also released from prison, having served his sentence for traveling with fake documents, but must stay in the country until an extradition decision is reached. Link.

- AI startup Anthropic is looking for a buyer to purchase shares previously owned by defunct crypto exchange FTX. FTX’s 8% stake in the company is now valued at more than $1 billion. Link.

- The SEC, Treasury Department, and CFTC all requested more resources to address the digital assets market in their 2025 budget requests. Link.

- Anchorage co-founder Diogo Monica joined Haun Ventures as a General Partner. Link. Blog Post.

- The Grayscale Ethereum Trust saw its discount drop to 20%, the lowest level since November 2023, due to pessimism surrounding approval of a spot Ethereum ETF. The trust plans to convert to an ETF, just as it did with its Grayscale Bitcoin Trust. Link.

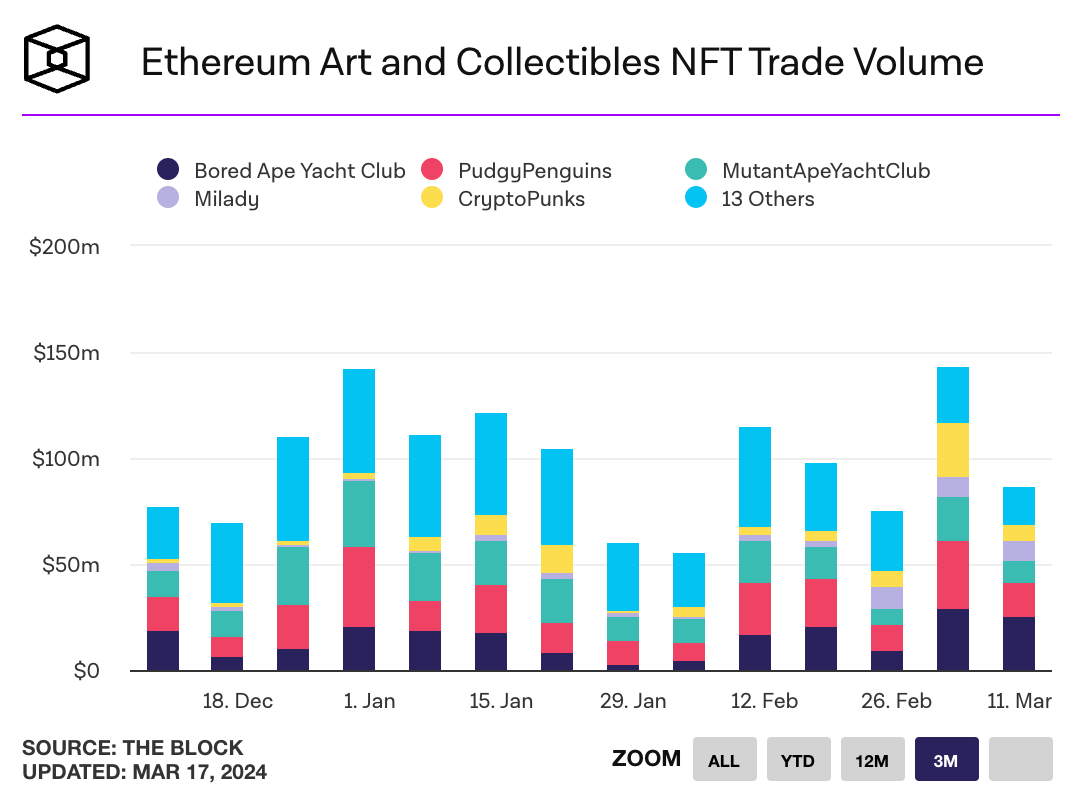

- An alien CryptoPunk sold for $16.4 million. Link. CryptoPunk.

- Former Binance CEO Changpeng Zhao is launching a gamified education platform called Giggle Academy. Link. Blog Post.

- Only 3% of Coachella NFTs that double as VIP passes have been minted. Link.

- New AML legislation in the EU will ban anonymous crypto payments over 3,000 euros by hosted or custodial wallets such as centralized exchanges. Link.