Crypto Weekly 11/13/22

A weekly summary of the latest crypto news...

PRICE CHANGE: WTD/YTD

- BTC ($16,538): -19% / -65%

- ETH ($1,227): -21% / -67%

- XRP ($0.34): -26% / -59%

- UNI ($5.87): -16% / -66%

- Crypto Market Cap ($832B): -18% / -63%

- BTC Dominance: 38%

- ETH Dominance: 18%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($66B): -5% / -15%

- USDC ($44B): +2% / +4%

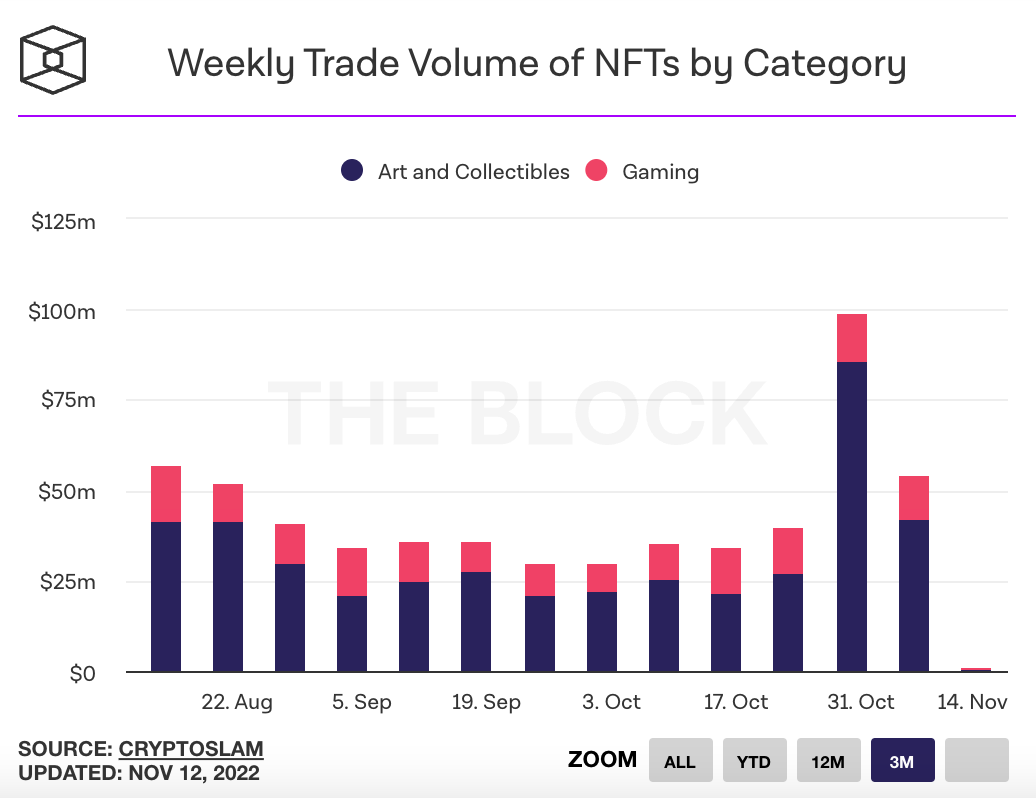

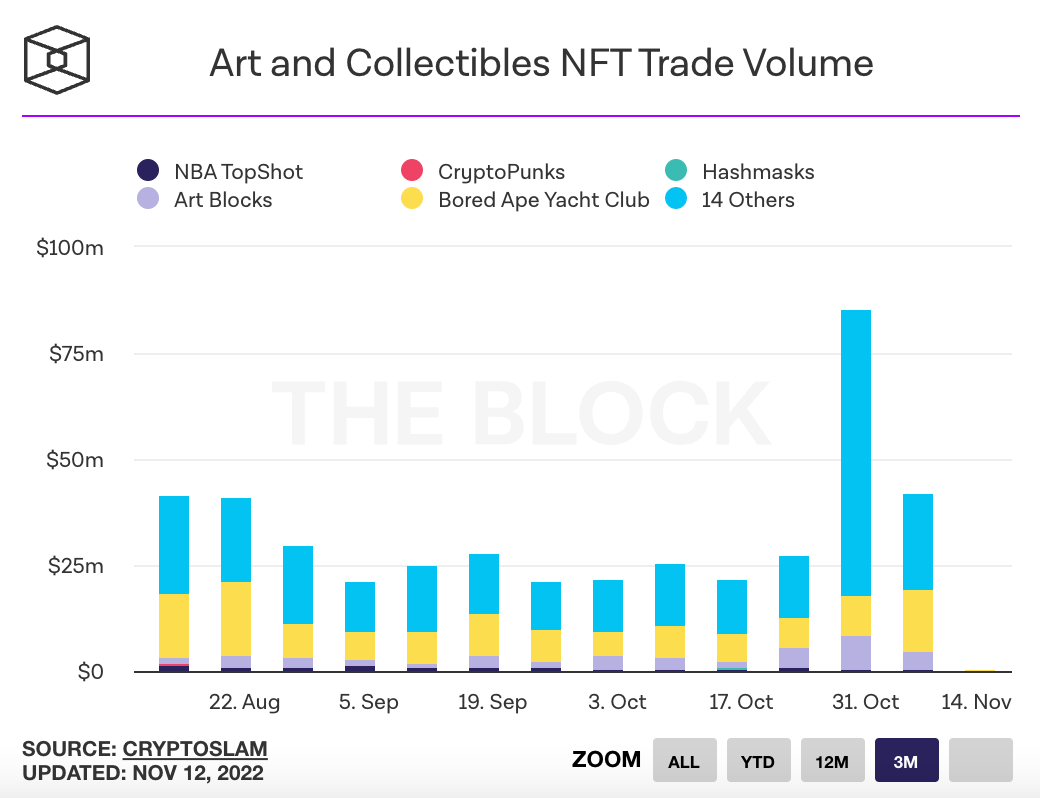

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

[Maaria Note] The dramatic collapse of crypto exchange FTX this week shocked the entire crypto community including myself. The second and third order effects of the exchange’s collapse are likely to affect the entire crypto ecosystem, from regulations to venture funding to mainstream crypto adoption. In my opinion, the events of this week highlight the problems with having trusted, centralized intermediaries in our financial system. A lot happened this week, so crypto weekly has a different format than usual.

TL;DR: FTX, one of the world’s largest crypto exchanges, filed for bankruptcy this week after losing over $10 billion of customer deposits. FTX’s founder and CEO Sam Bankman-Fried is said to have sent customer deposits to its trading partner, Alameda Research, which had suffered significant losses earlier this year in the wake of the Luna / Terra / 3AC market crash. The scheme unraveled this week when the exchange was unable to fulfill $6 billion in withdrawal requests due to insufficient liquidity. Bankman-Fried had reportedly built a ‘back-door’ in the exchange that allowed him to transfer assets between FTX and Alameda without raising red flags. FTX was a crypto behemoth before this week: it was valued at $32 billion in January 2022 and Bankman-Fried was well-known for his lobbying efforts with regulators and lawmakers. The dramatic collapse of the exchange wiped roughly $200 billion from the crypto markets.

The Players:

“SBF” = Sam Bankman-Fried. Founder and CEO of crypto exchange FTX. Also founder of Alameda Research.

Alameda = A hedge fund and market maker. Founded by SBF and led by Caroline Ellis. Viewed by many as the unofficial trading arm of FTX.

FTX = crypto exchange founded by SBF. FTX operated 2 exchanges: FTX and FTX US. FTX Global was incorporated in the Bahamas and did not have the same regulatory oversight as FTX US.

Binance = world’s largest crypto exchange founded by "CZ".

“CZ” = Changpeng Zhao. Founder and CEO of Binance.

FTT = token issued by FTX that offers holders discounts on FTX trading fees among other perks. It is not backed or collateralized by any assets.

Part 1: Alameda’s Balance Sheet

- Coindesk reported that SBF’s trading firm Alameda Research held 40% of its $15 billion of assets in FTX’s native token FTT, a free floating token issued by FTX.

- The report also indicated that Alameda held $8 billion of liabilities, drawing concerns of a potential asset - liability mismatch given their significant FTT holdings and the token’s low float at the time. Coindesk article.

- Alameda alleged there were $10 billion of assets off balance-sheet that were not reported, but failed to give more transparency. Tweet.

Part 2: CZ vs SBF

- Binance CEO CZ then announced plans to liquidate $2 billion FTT tokens “due to recent revelations that have come to light”. Binance had received the FTT tokens in exchange for divesting its equity interest in FTX in 2021. Tweet. The Block. Fortune.

- FTT fell from ~$25 to $23 on the news, causing Alameda CEO Caroline Ellis to publicly offer to buy Binance’s FTT tokens at $22. Tweet. CZ refused, causing FTT to fall below $5, wiping out more than $2 billion in market cap value in a day. CZ Tweet. CNBC. Decrypt. Coindesk.

- FTX received $6 billion in withdrawal requests over 72 hours as the FTT price crash exacerbated fears over Alameda’s insolvency and its close ties to the exchange. Reuters. The Block.

- SBF assured the market that FTX assets were fine despite the FTT sell-off. Tweet.

- FTX Global halted withdrawals the next morning and announced that Binance had signed a non-binding LOI to acquire the exchange and help with the liquidity crisis. The deal excluded FTX US. SBF Tweet. CZ Tweet.

- Binance pulled out of the deal within 24 hours, citing FTX’s mishandling of customer funds and regulatory concerns. Binance Tweet. Decrypt.

Part 3: FTX declares bankruptcy

- After Binance pulled out of the deal, SBF reportedly tried to raise as much as $8 billion from investors to fill FTX Global’s balance sheet hole. NY Times. Semafor. The Block

- SBF approached Tron’s Justin Sun, Coinbase, Kraken, and other investors to acquire the exchange. Axios. The Block. Coindesk.

- Financial Times reported that FTX had only $900 million in liquid assets against $8.9 billion in liabilities. SBF was reportedly looking to raise $10 billion from investors, up from $6 billion reported earlier. Financial Times.

- FTX reportedly held $5.5 billion in less liquid assets and $3.2 billion in illiquid assets on its balance sheet. The largest holdings were in high market cap, low volume cryptocurrencies like Serum, Solana, and FTT. FTX had also invested in over 250 crypto startups. Bloomberg. The Block.

- SBF had reportedly lent $10 billion of its $16 billion customer deposits to Alameda. WSJ. Coindesk. At least $4 billion had been lent in May and June, after the trading firm suffered huge losses during the Terra / Luna and 3AC collapse. Reuters. The Block. Decrypt.

- SBF reportedly built a “backdoor” to the FTX exchange to change financial records and move funds without alerting others. This allowed him to move $10 billion of assets to Alameda without raising any alarms. Only a handful of FTX employees were aware of the arrangement. Reuters. CNBC. Coindesk.

- With no clear path to raising the capital, SBF filed FTX, FTX US, and Alameda for Chapter 11 bankruptcy. Press Release. NY Times.

- Prior to this week’s events, SBF’s net worth was estimated to be $15.6 billion. Bloomberg.

- SBF resigned as the firm’s CEO and appointed John Ray III as acting CEO to help with the liquidation. Decrypt.

Part 4: FTX gets hacked

- Following the bankruptcy filing, more than $600 million of crypto assets were drained from FTX and Alameda wallets on Friday night. Over $470 million is suspected to have been stolen by a bad actor, while the remainder was moved to consolidate assets for the bankruptcy proceedings. Bloomberg. Washington Post. The Block.

- The alleged hacker used crypto exchange Kraken to offload the stolen funds. The exchange said it had identified the account in question and was cooperating with law enforcement. The Verge. Coindesk.

- The hacker sold hundreds of millions of various cryptocurrencies, causing significant pressure on price. Stolen assets include: Paxos Gold, Sushi, ApeCoin, Lido, Matic, Uniswap, Aave and Synthetix. 0xfoobar reporting.

- Many FTX wallet holders reported $0 balances following the hack. It is unclear what amount, if anything, remains for bankruptcy proceedings. Coindesk.

- FTX warned its 1.2 million customers it had been hacked, and advised users to not visit the FTX website or update its mobile application. Crypto News. Plaid suspended its connection with FTX, after Twitter users reported that FTX US had attempted to access their bank accounts through Plaid. Coin Telegraph.

Part 5: Contagion

- The SEC, CFTC, US Department of Justice, and Bahamian authorities are all investigating FTX. Bloomberg. WSJ.

- Some members of Congress are pushing to move forward with the upcoming stablecoin and crypto bill, DCCPA. The bill’s proposed regulation of DeFi has been a point of contention for the crypto community. The Block.

- Stablecoin issuer Tether froze $46 million of USDT held by FTX at the request of law enforcement. Coindesk.

- Crypto lender BlockFi paused client withdrawals. It had received a $400 million revolving loan from FTX earlier this year, and had moved its assets to the exchange. Bloomberg. Decrypt. BlockFi statement.

- Centralized exchanges began issuing ‘proof of reserves’. Binance, Crypto.com, Kraken and others published on-chain reports verifying their balance sheet assets. Decrypt. The Block.

- FTX was heavily embedded in the Solana ecosystem and owned 10% of the network when it collapsed, causing SOL to crash over 60% in the last 7 days. Forbes.

- FTX was the sole liquidity provider for soBTC, a wrapped version of bitcoin that allowed the cryptocurrency to be traded on the Solana network. FTX was also a launch partner for Serum, a DeFi trading protocol built on top of Solana that has done $32 billion in trading volumes. Forbes. The Street.

- Solana developers are forking FTX-developed token Serum after discovering the private key for the protocol was controlled by someone at FTX. The Block.

- FTX was valued at $32 billion in January 2022 and had raised over $1 billion in capital from institutional investors. Those investments are being written off in the wake of FTX’s bankruptcy. Investors include: Sequoia Capital ($214 million). Ontario Teachers Pension Plan ($95 million). Paradigm ($278 million). The Block. NY Times. Economic Times. Sequoia Letter.

- Crypto venture firm Multicoin Capital said 10% of its assets under management were stuck in the exchange. It also had indirect exposure to the FTX meltdown through its positions in Solana and Serum. The Block. Multicoin Letter.

- Crypto exchange Kraken said it holds 9,000 FTT, but does not list the token on its spot or futures exchange so was not affected by the collapse. The Block.

- Crypto lending and trading firm Genesis had $175 million stuck in FTX. It received $140 million emergency equity infusion from its parent company DCG. Coindesk.

- Crypto fintech firm Galaxy Digital had around $80 million of cash and digital assets tied to FTX. Coindesk.

- Bankrupt crypto lender Voyager reopened the bidding process for its assets. FTX was in the process of purchasing Voyager’s assets prior to its collapse. The Block. Voyager Press Release.

- The White House said it would be taking a “harder look” at the crypto world following FTX’s implosion. Decrypt. White House Briefing.

Other headlines:

- Ethereum turned deflationary for the first time since migrating to proof of stake in September. This means more ETH is being burned on transaction fees than being rewarded to validators maintaining the network. Link.

- OpenSea said it would continue enforcing creator royalties on its marketplace, after getting pushback from NFT creators. Link. Link.

- The Consumer Price Index rose 0.4% in October, better than expectations of 0.6%. The news caused a brief rally in crypto prices, most notably BTC gaining 10%. Link.

- The US Treasury Department updated its sanctions against coin mixer Tornado Cash. The sanctions now specifically target individuals from North Korea’s WMD program instead of including the software’s founders, core developers, DAO members or any other users of the software. Link.

- Over 24,000 crypto jobs have been eliminated YTD. Link.

- Crypto venture fund Paradigm has launched a crypto policy council that includes former Speaker of the House Paul Ryan, former US congressman Steve Israel and 6 others. The council will advise Paradigm leadership on crypto policy issues and will not do any external lobbying. Link.

- The SEC won a case against LBRY Protocol for selling an unregistered security, a ruling viewed by many crypto advocates as a dangerous precedent. The case is expected to be appealed. Link.

- The DOJ seized over 50,000 BTC last year affiliated with darknet marketplace Silk Road. It was the second largest seizure of BTC ever. Link.