Crypto weekly is co-authored by @serdave

The trial of Sam Bankman-Fried started this week, so you'll notice this week's Crypto Weekly includes a dedicated section for trial coverage. The trial is expected to last ~6 weeks and we'll continue with this format based on your feedback and suggestions. Let us know what you think!

PRICE CHANGE: WTD/YTD

- BTC ($27,818): +2% / +68%

- ETH ($1,624): -3% / +36%

- SOL ($23.13): +1% / +137%

- UNI ($4.31): -5% / -16%

- MATIC ($0.56): -1% / -26%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.09T): +1% / +37%

- BTC Dominance: 50%

- ETH Dominance: 18%

- Tether ($83B): 0% / +26%

- USDC ($25B): +2% / -42%

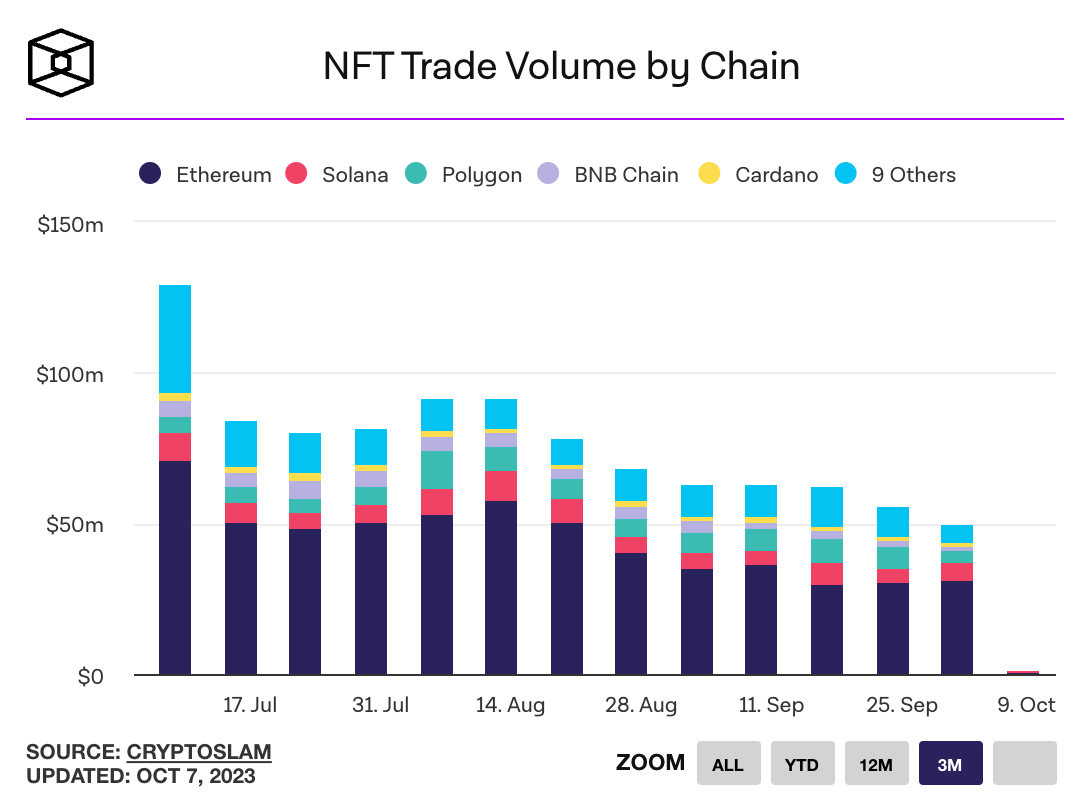

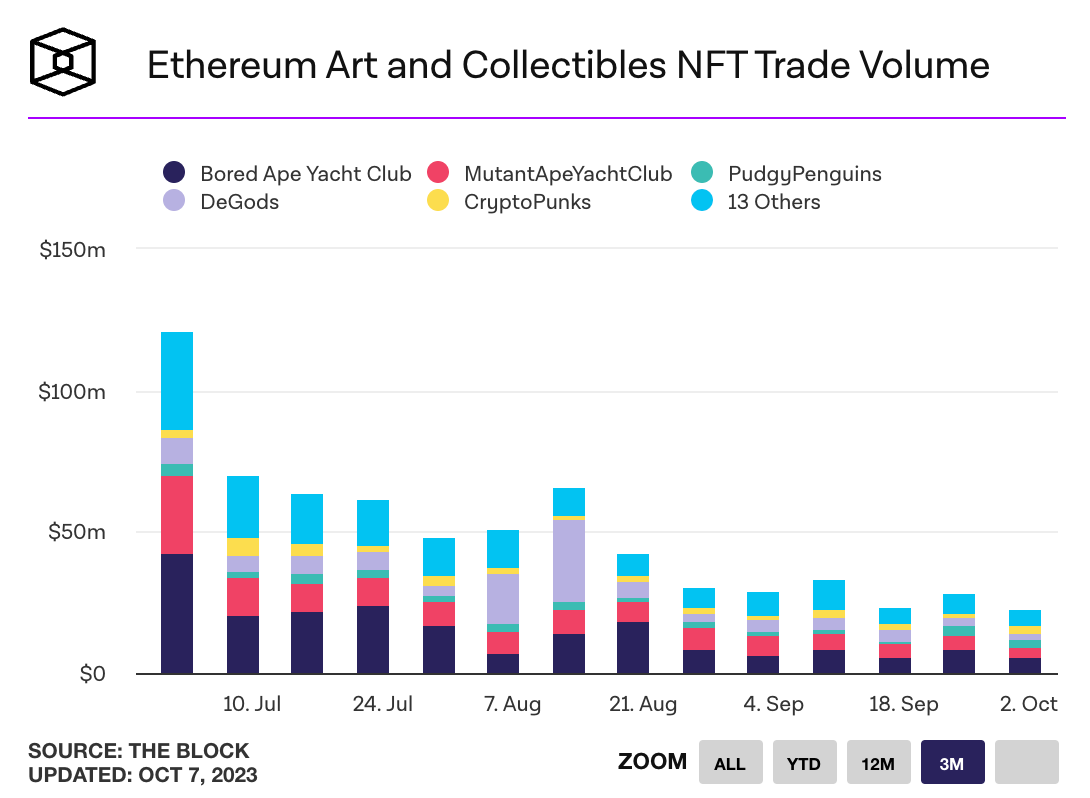

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- The judge in the SEC vs Ripple case denied the regulator's request to appeal her decision before the case concludes next year. The SEC had argued that the ruling would impact many of its ongoing cases. Link.

- Nine Ethereum futures ETFs launched this week with a combined trading volume of $2 million, compared to the $1 billion volume of the first Bitcoin futures ETF when it debuted in 2021. Link.

- Crypto fundraising hit a 3-year low of $2.1 billion across 297 deals in Q3, down from a peak of $17.5 billion across 900 deals in Q1 2022. Link. Report.

- The market cap of stablecoins has declined 35% since the collapse of Terra’s UST 18 months ago. The majority of the decline has come from Circle’s USDC, while Tether’s USDT has seen a slight increase in market cap. Link.

- Biographer Michael Lewis told 60 Minutes that SBF offered Donald Trump $5 billion to not run for president in 2024, and that SBF saw the $8 billion in missing FTX customer funds as a rounding error. Link. Link. Interview.

- Ethereum co-founder Vitalik Buterin authored a blog post debating whether certain protocols should be added to Ethereum’s code base or continue to live “on top” of the blockchain. Account abstraction, liquid staking, private mempools and code precompiles were discussed, and Buterin expressed concerns over centralization of the liquid staking market. Link. Blog Post.

- Grayscale filed an application to convert its Ethereum Trust to a spot ETF. Grayscale won a lawsuit against the SEC this summer over the handling of its application to convert its Bitcoin Trust into a spot ETF, but that application has yet to be accepted. Link.

- Blackbird Labs, an NFT loyalty app for restaurants, raised $24 million in Series A funding led by a16z. Link. Link.

- The number of active crypto developers has declined to its lowest number since 2020, according to an analysis of crypto-related Github repos. Link. Report.

- Hardware wallet maker Ledger cut 12% of its staff. The company raised $109 million at a $1.4 billion valuation earlier this year. Link. Link.

- Polygon co-founder Jaynti Kanani announced he is leaving the company. Polygon had a shakeup over the summer when chief legal officer Marc Boiron was promoted to CEO and President Ryan Wyatt stepped down to serve in an advisory role. Link. Announcement.

- Blockchain analytics firm Chainalysis cut 15% of its staff this week. Link.

- A Federal Reserve report indicates that Silvergate’s collapse earlier this year was due to the bank’s overreliance on servicing crypto clients. Link. Report.

- Stars Arena, a friend.tech clone launched on Avalanche, was hacked for $3 million, roughly all of its locked funds. Link.

- Yuga Labs, the startup behind Bored Ape Yacht Club, announced layoffs amid a company restructure to focus on their metaverse platform Otherside. Link. Link. Announcement.

- The Museum of Modern Art (MoMA) announced an NFT project with Tezos. “MoMA Postcast” will let people send digital chain letters to each other, using “stamps” created by 15 digital artists. Link.

- The SEC is expected to approve all Bitcoin spot ETFs simultaneously to prevent a first-mover advantage. The decision could come in the next 3 to 6 months. Link. Link.

- Developer studio Burnt is launching a layer 1 blockchain, Xion, that uses USDC as its base currency. Circle Ventures is a strategic investor. Link.

SAM BANKMAN-FRIED TRIAL COVERAGE

Trial transcripts have not been released, so trial highlights cited below are based off second-hand recaps from journalists and others reporting on the case.

TUESDAY

- The government confirmed it had never offered Sam Bankman-Fried a plea deal

WEDNESDAY

- In opening statements, prosecutors argued SBF deliberately lied and knowingly allowed his hedge fund Alameda Research to illegally borrow FTX customer deposits

- Defense lawyers argued the loans FTX made to Alameda were legal, and the exchange’s insolvency was the result of mismanagement, not criminal intent.

- Adam Yedidia, a college friend of SBF’s who eventually joined FTX as a software engineer, testified that FTX did not have its own bank account until 2022, and had used an Alameda-controlled account at Silvergate Bank to accept customer deposits.

THURSDAY

- Paradigm co-founder Matt Huang said the firm had marked its $278 million investment in FTX to $0.

- FTX CTO Gary Wang, who has pled guilty to charges and agreed to cooperate with prosecutors, testified that Alameda had been allowed to have a negative balance at FTX as early as July 2019. This allowed the hedge fund to bypass automated procedures at the exchange and withdraw more than it had deposited.

- Wang testified Alameda had a negative balance of $200 million in early 2020, which was higher than FTX’s revenues from trading fees at the time. The difference was made up with a ‘line of credit’ funded by customer deposits.

- SBF eventually authorized a $65 billion line of credit to Alameda, giving it virtually unlimited access to FTX customer deposits.

FRIDAY

- Wang testified that SBF contemplated shutting Alameda down in September 2022, but had no way of covering the $14 billion the hedge fund had borrowed.

- Wang said the exchange was short $8 billion of customer deposits in November 2022

- A few days after FTX declared bankruptcy SBF ordered Wang to transfer FTX’s money to Bahamian securities officials, because they “seemed friendly” and would allow SBF to preserve some stake in the business.

NEXT WEEK

- The defense will resume cross-examination of Wang on Tuesday.

- Alameda CEO Caroline Ellison is expected to testify next. Like Wang, she has pled guilty to charges and agreed to cooperate with prosecutors.

Great coverage from: Slate, Unchained, WSJ